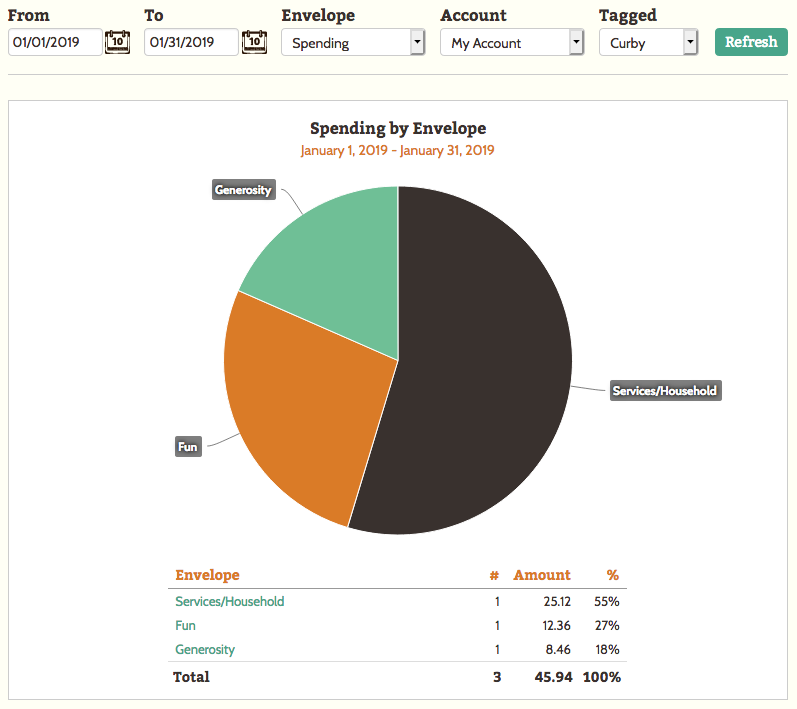

I recently got a puppy named Curby. She’s a fearless little Chihuahua-mix that enjoys napping in laps, chewing on shoelaces, and sunbathing on the deck. At first I wasn’t sure how to include her in my regular budget, so I decided to add her expenses in my existing Envelopes and tag them with #Curby in the notes section. This would let me keep track of how much I spent on her, without having to change my existing budget. It wouldn’t work as well if my Curby expenses outweighted my regular expenses, but how much could a little dog cost? A month later, Goodbudget showed me the answer. I went to my Spending by Envelope Report and selected “Curby” under the Tagged filter to see how much I spent. Tiny as she is, expenses for Curby grew bigger and bigger—a squeaky chew toy here, gummy bear-flavored shampoo there, not to mention her shots and food.

I recently got a puppy named Curby. She’s a fearless little Chihuahua-mix that enjoys napping in laps, chewing on shoelaces, and sunbathing on the deck. At first I wasn’t sure how to include her in my regular budget, so I decided to add her expenses in my existing Envelopes and tag them with #Curby in the notes section. This would let me keep track of how much I spent on her, without having to change my existing budget. It wouldn’t work as well if my Curby expenses outweighted my regular expenses, but how much could a little dog cost? A month later, Goodbudget showed me the answer. I went to my Spending by Envelope Report and selected “Curby” under the Tagged filter to see how much I spent. Tiny as she is, expenses for Curby grew bigger and bigger—a squeaky chew toy here, gummy bear-flavored shampoo there, not to mention her shots and food.