Credit Card Accounts represent owed balances that you accrue and then pay off in full each month, and Debt Accounts represent owed balances that you’re working to pay off over time.

To put it another way, if you pay your credit card in full each month, it should be put into Goodbudget as a Credit Card Account. If you’re working to pay down a credit card balance, then it should be entered as a Debt Account. Debt Accounts can also be used to track other non-credit card owed balances that are being paid down, such as student loans or mortgages.

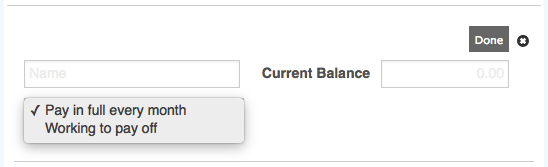

You can create both types of Accounts on the Add/Edit Accounts page. When you create a Credit Card or Debt Account, you will see a dropdown menu with two options “Pay in full every month” and “Working to pay off”.

If you select “Pay in full every month”, the Account you created will be a Credit Card Account, regardless of whether you started creating the Account in the “Credit Cards” or “Debt” sections of the page. The same is true for the “Working to pay off” option, which will create a Debt Account regardless of which section was first chosen.

Note that while there is no limit on the number of Debt Accounts you can have in a Goodbudget household, Credit Card Accounts count toward the 1 Account limit on the Goodbudget Free plan.